A family of four could receive up to $5,600. Democrats in the House have proposed sending direct payments worth up to $1,400 per person. Those who may have earned more in 2020 than 2019 are not required to pay back money they have already received.Ĭongress is considering a third round of paymentsĬongress is negotiating a fresh stimulus package that may include a third round of stimulus checks. The credit eligibility and the credit amount will be based on the 2020 tax year income. If that’s the case, they may claim a “Recovery Rebate Credit” on their 2020 tax return.

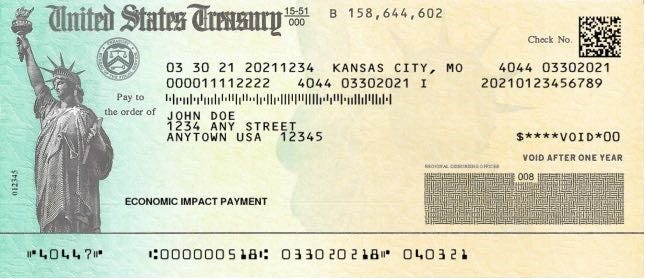

That means that someone who lost their job or otherwise saw their income drastically fall in 2020 may be eligible for more money than they first received. The first two rounds of stimulus payments were based on a taxpayer’s 2019 income. The smaller payments phased out faster, cutting off individuals who earn more than $87,000 a year and couples without children earning more than $174,000 a year. Not everyone who received money in the initial round of $1,200 payments that went out last spring was eligible for the second $600 check. About $142 billion was sent, helping boost retail sales in January for the first increase in months. More than 147 million payments were issued for the second round, which was authorized by Congress in late December. Those who aren’t required to file federal taxes because they earn too little may have also missed out and will have to file a return this year to get the cash.

The IRS was required to issue the payments by mid-January so that it could move on to processing this year’s tax returns.Įligible people who have moved or changed bank accounts since they filed their 2019 tax returns may not have received the money but can claim it on their 2020 tax return. While it’s possible that some paper checks or debit cards are still in the mail, there could be some eligible recipients who haven’t received their money and will have to claim it on their 2020 tax return. What you need to know about the new stimulus child tax credit.Debt collectors can seize stimulus checks.IRS plans to delay this year’s tax filing deadline to mid-May.Stimulus payments hitting some Americans’ bank accounts.

“This is the most consequential legislation that any of us will ever be a party to,” House Majority Leader Nancy Pelosi said on Wednesday after the passage of the bill.Įditor’s note: This is an opinion piece and is not meant to offer tax or financial advice on behalf of the author or TNI.Įthen Kim Lieser is a Minneapolis-based Science and Tech Editor who has held posts at Google, The Korea Herald, Lincoln Journal Star, AsianWeek, and Arirang TV. In addition to the direct payments, the bill provides an extension of the $300 per week enhanced jobless aid for millions of unemployed Americans and an expansion of the Child Tax Credit for low-income households.Īccording to a recent study conducted by the Pew Research Center, nearly half of Americans are still experiencing financial pain one year after the coronavirus pandemic ground the economy to a halt and caused massive layoffs.

#Most recent stimulus check full#

Also, contributing more to tax-favored retirement or health savings accounts or deferring income, such as waiting to sell a business stake or stock, could keep your income within the limit to qualify for the full stimulus check amount. Since the IRS will use the most recent AGI in its system, know that it is probably smart to wait a little while to file your taxes if you qualify for a bigger stimulus check based on your 2019 income. Taxpayers will receive the same amount for each dependent. The payments phase out much more quickly than in previous rounds-an individual with an income of $80,000, or a couple with $160,000, will receive nothing. Families in which some members have different citizenship and immigration classifications are eligible for a payment, if at least one person has a Social Security number. Single parents with at least one dependent who earn $112,500 or less also get the full amount.

0 kommentar(er)

0 kommentar(er)